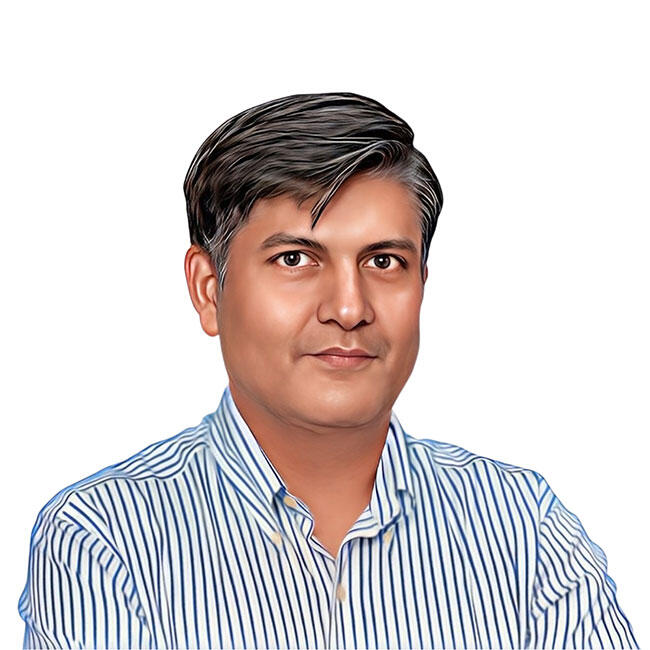

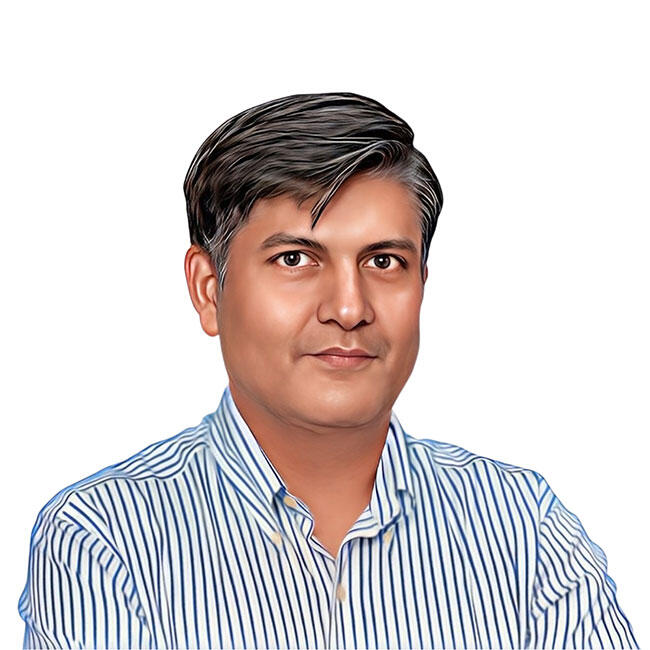

Ashish Jain

Co-Founder and Partner

My success mantra is that there is no mantra. It is like being on a football field. You have to strategize in real time, stay focused on an outcome but don’t shy away from course correcting.

The most exciting part about investing is that you get to live as many lives as your firm’s portfolio, each one unique and each one with its own set of outcomes and learnings which you can share and cycle back in real-time.

Open and honest communication helps maintain a healthy founder-investor dynamic. When you invest the purpose is not to form a cushy relationship, after all an outcome has to be delivered within a timeframe which naturally leads to conflicts. Yet relationships with founders do transcend beyond the realm of the transaction.

WaterBridge is being built brick by brick into an institution of its own class. When you are part of a script as rich as this, you naturally feel excited. You want to give your best. The dots of today are getting connected fast and will evolve into a grand picture tomorrow.

I am able to empathize with entrepreneurs because I have been entrepreneurial in my personal decision making, have taken risks in my life, and lived through uncertainties of what lies beyond the curve.

Founders are often overstretched. They know that I can be reached easily but they also know that I will always expect them to stay focused and be persistent.

I am not prescriptive because things take far longer to settle down in start-ups. You will have to prioritize what you want to optimize. There are far too many things to work on and not everything can be set right.

Active Investments

Past Experience

- Acuity

- Singhi Advisors

- Actis Capital

- Xander Investments

- Lok Capital

- Escorts

Education

- Delhi University

- ICAI

View All Team Members

View All Team Members