About Us

We are committed to being the first and most active VC partner to founders

Total capital raised by our portfolio

$969M

Combined investing experience of Partners

40 Years

Portfolio Companies

35

Why Us

We back contrarian founders and consistently spot opportunities before they become obvious to others

Why Us

Our eclectic networks help us partner with pioneering global product teams from India

We are a signatory to the Principles for Investors in Inclusive Finance (PIIF) – a responsible investment framework for investors focused on expanding access to affordable and responsible financial products and services to those traditionally excluded

Our Founders & Portfolio

“From our first conversation itself, WaterBridge felt like true partners, trusting our vision, helping with connections and most importantly keeping it real and grounded”

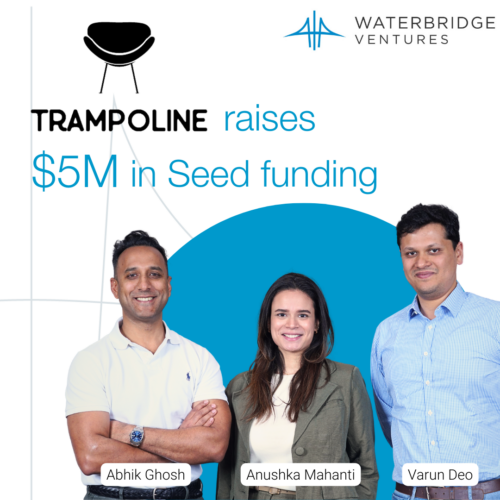

Varun Deo, Abhik Ghosh, Anushka Mahanti – Trampoline

“WaterBridge has been a source of sage advice and constant support for us – a true partner in building Magicpin”

Anshoo Sharma – Magicpin

“WaterBridge has been an absolute pillar of strength for us and we hope to scale insane heights together to build a truly breakout company”

Saurabh Pandey – Eloelo

“Many can give you money, but only WaterBridge will help you think big, and will roll up their sleeves to actually help you get there. If you are a Series A or Seed stage startup, we would strongly recommend you to take WaterBridge over anyone else including all the big names”

Dhruv Chopra, Mohit Dubey, Priya Singh, Vinayak Bhavnani – Chalo

“From the get-go, WaterBridge respected our time, moved quickly and began to add value before they even made an investment”

Prukalpa Sankar, Varun Banka – Atlan

News & Insights

Beyond the Top 25 Cities, India’s 400+ Towns Present a $200B Consumer Opportunity

November, 2024

Popular View

Founders come from a traditional brick-and-mortar business with no tech-start-up expertise. K-12 Ed-Tech space requires differentiated content to succeed.

Our View

Founders understand the student pain point better than >150 Ed-Tech start-ups we met in K-12. Product-first approach and content pull via DIY doubt-solving for Bharat will be the differentiated growth strategy.

WaterBridge led Seed in 2018.

Today

DoubtNut is India’s most used and fastest growing Ed-Tech App tapping into 135m vernacular students. Differentiated further by low CAC and a content development engine of >4m videos feeding into its ML engine. We exited DoubtNut during its acquisition by Allen Career Institute in 2023.

Popular View

Another grocery delivery app in a red ocean market with JioMart being an established behemoth. Group buying and small town focus is not a differentiator.

Our View

Trust based local and assisted commerce is more likely to work in small Indian towns. Contribution margins can make sense for daily consumables if local micro-entrepreneurs can be tech co-opted.

WaterBridge invested in Pre-Series A in 2020

Today

CityMall is a Series C company that has pioneered a locally driven, assisted, community driven, group buying platform in India. Targeting the over 300M value focused small-town Indian consumers for whom offline supermarkets options for attractive deals and offers are literally far and few. CityMall has built trust in transacting on mobile through local community leaders under an assisted group buying model with a market leading presence across 10 cities.

Popular View

B2B e-commerce already has Udaan as a winner, not sure about another B2B player. Business focused on footwear as a category and not sure of market depth or expansion possibility beyond footwear.

Our View

Founders are the right ‘horses for this course’ given family business background in footwear. Dogged supply-side focus together with tech-led disruption will create a profitable business and long-term moats.

WaterBridge led Pre-Series A in 2019

Today

Bijnis is a Series C Company with over 4,000 manufacturing units or factories using the app to drive demand and receiving orders from >50,000 registered retailers. With 100% of operations being tech-enabled, Bijnis has expanded beyond footwear into apparel and accessories and counts Info Edge, Matrix, WestBridge and Sequoia among its investors.

Popular View

An erstwhile auto-retail i.e. CarWale entrepreneurial team cannot solve for intra-city, public transport. This is a small and highly regulated market

Our View

Founding team has an optimum combination of operations and technology skill sets to disrupt the space. Bus mobility is 4x of ride hailing market. Tech-driven business model and supply side partnerships can create moats.

WaterBridge led Series A in 2017

Today

Chalo emerged as the best resurgence story in mobility post-CoVID. Chalo is India’s largest platform for mass daily commute. A Series D company, Chalo counts Avataar Ventures, LightRock, Raine and Xiaomi among its investors. Chalo has acquired other mobility startups like Vogo and Shuttl.

The Pitch

Prukalpa and Varun had launched “Data for Good” company SocialCops with customers like the UN and India’s National Data Platform.

Our Partnership

WaterBridge led the first institutional seed round in 2018 and SocialCops pivoted to build a product in the data management space. Atlan was born in 2020 as a home for data teams in the modern data stack. Marketing and sales focused towards the US with a global development model were architected along with early PMF.

Today And Ahead

Atlan is often referred to by experts as a “Data Discovery Rocketship”. Atlan’s cloud-native, governance-enabled DataOps platform creates a common collaboration workspace for diverse data consumers like analysts, scientists & business users. Its no-code query builder allows less technical teams to partner with data teams to explore data and allows the data to easily be pulled into analytics and Business Intelligence tools like Tableau & PowerBI. Raised $173 million cumulatively till date, with the latest round being a $105M Series C in 2024, led by GIC, Meritech Capital, with participation from existing investors Salesforce Ventures, PeakXV Partners and Insight Partners.

The Pitch

Pharma science graduates, Raj and Harj ran a pharmacy chain in Canada and IIT Delhi alum and technologist Abhinav had just taken his company Rocket Fuel public on NASDAQ. Together, they made for a formidable founder-market fit with both tech and industry expertise.

Our Partnership

WaterBridge led the first institutional seed round in 2019 when they launched PocketPills. They quickly secured a first mover advantage as Canada’s foremost online pharmacy and expanded to five provinces. Raj and Harj’s expertise from building an offline chain of pharmacies made navigating the regulatory maze easier and securing partnerships, early on, with big pharma companies.

Today and Ahead

PocketPills is the largest digital pharmacy in Canada. They bring a frictionless online pharmacy experience with subscription-driven models, free delivery anywhere in Canada and robotics-driven warehouse automation. Beyond pharma, they provide comprehensive care plans and telemedicine APIs to embed services into products. Raised CAD 35 million with WaterBridge participating in each round since our first.